Q&A

Swaps transactions

1.How to participate in the swaps transactions?

Clients need to open an trading account under the name of a offshore company or the individual in the clearing bank like DBS etc. Then they can start trading through the broker company after they put enough margin in the account and sign the IDB contract with the broker company.

2.How does the margin system work?

At present, the initial margin is $2200 and the maintenance margin is $2000 per lot of 62% swap contract in the current month, and the forward contract declines month by month. Exchange will clear all position holding by the clients, and deduct a sum amount of loss accordingly if there exists any potential loss. When account balance is less than $2000 per lot, client needs to make up the margin over $2200 per lot.

3.How is the iron ore swap transaction settlement price made?

Swap transaction conducts daily settlement price as the same way as the futures. Settlement price is conducted by the Exchange in the way of collecting marketing price and calculating in particular algorithm in order to calculate the profit or loss and potential risk. At the last publication day of TSI, the Exchange will settle the current month contract holding by the client, and the final settlement price is the arithmetic average of all TSI in current month, and two trading sides will pay or charge according to the situation of profit and loss by cash.

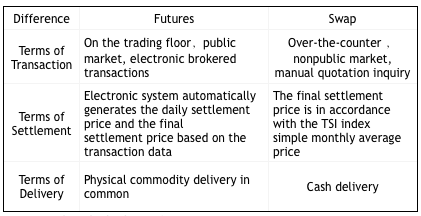

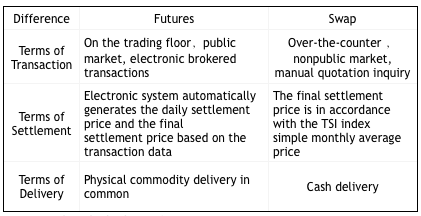

4.What’s the same and difference between Swap and Futures?

Swap is quite similar with futures, both of them realize the two major function as risk elusion and price discovery via forward contract trading. The difference is the way to deal and settle:

5.How much is the brokerage?

It contains three parts in the brokerage of Swap trading: Exchange and Clearing house charge $20 per lot of the contract and Broker company charge $0.1 per tonnes unilaterally.

6.Risk management for physical traders using swaps?

- Traders have physical commodities or long position of long-term agreement, when market price unilaterally falling down, they can sell the forward contract to hedge the risk of continuing falling;

- When the market price is falling, the supplier is forced to sale stock in order to minimize its risk. The trader can also sell the forward contract to hedge falling risk in this situation, hence buying commodities from supplier in order to keep relationship of long term cooperation. As a result, it benefits both parties and prevents from big loss.

7.What kind of risks existing in Iron Ore Swaps?

Swaps Trading is a derivative designed to cooperate with physical trading. There is nearly no risk if clients only use swop to hedge their physical situation rather than speculation. However, margin can be one of the risk factor. Clients need to keep a close look on their margin, whenever there is margin call; they’ll need to act quickly to avoid mandatory liquidation. Meanwhile, if the physical price goes opposite to expectation, client will be exposed to risk and loss on both physical and swaps.

8.How to get the swaps prices in a timely manner? How to trade swaps?

Brokers (Socius) will send market price and related info. via phone calls, text massage, QQ, Wechat or Yahoo Messenger(or other instant messengers) to our clients in a timely manner and the specific inquiry and offer feedback to broker also via the same means of communication. Clients can register in clearing platform of the Exchange after brokered by brokers.

9.Will there be a trading party in a Unilateral downward market?

There are variety player in the market such as banks, arbitragers, trading houses, mines, steel mills etc. As the natures of these parties are different, it is obvious that they have different trading objectives and strategies. Even in a unilateral market, there will always be player trading the opposite direction.

10.what’s IO swap volume traded at the moment? How about of the liquidity??

There are over 400 clients have already opened accounts with SGX, the volume is about 1 to 2.50 million tonnes per day and it reached a record high of 6million tonnes in one day. It’s a fair big market. As long as the price is not over or below the market, it should be very easy to match one’s price in such a liquid market.

[top]